It's a tough economy out there and many people are desperate for any kind of work. Desperate times call for desperate measures when the bill collector comes a calling. Getting ahead requires thinking outside of the box. But, don't just take my word for it.

Cassies - "The Pitch" from Cartilage Inc. on Vimeo.

Wednesday, November 30, 2011

Tuesday, November 29, 2011

Quants: The Alchemists of Wall Street

The credit crisis has shown how the global financial system has become increasingly dependent on mathematical models trying to quantify human (economic) behavior. What are the risks of treating the economy and its markets as a complex machine? Will we be able to keep control of this model- based financial system, or have we created a monster?

Source: VPRO Backlight

Source: VPRO Backlight

Thursday, November 24, 2011

Happy Thanksgiving!

Well, as the markets have show these past two weeks, investors' economic fears (perhaps justifiably) have gotten the best of them. I'm not sure where we're headed in the near future, but if the markets keep heading south, I'm looking to capitalize on the opportunities being presented. In my opinion, things aren't as bleak as is being reported or being perceived by investors.

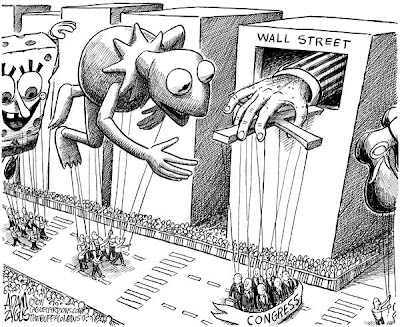

In this corrupt corporatocracy we live in, there are many things I could find fault with, but at least for today, I'm thankful for the non-financial things in my life, especially my good health. I hope you feel the same way and I wish you a very Happy Thanksgiving!

Image Source: Adam Zyglis: The Buffalo News

In this corrupt corporatocracy we live in, there are many things I could find fault with, but at least for today, I'm thankful for the non-financial things in my life, especially my good health. I hope you feel the same way and I wish you a very Happy Thanksgiving!

Image Source: Adam Zyglis: The Buffalo News

Sunday, November 20, 2011

Weekly Wrap

It was a rough week for me this previous week. The three major market indexes ended the week with a 3-4% loss. Not only was I wrong about where the stock market would end for the week, but the flu hit me like a ton of bricks on Thursday. My body felt like it was pummeled with a 2x4. I'm just finally getting halfway back to normal today.

So, how was it that the often infallible Oracle of Burbank wasn't able to mystically forecast this past week's market movements with his usual accuracy? Like most intangible things, my reasons can't easily be quantified, but I think this best describes my situation for the week -

So, how was it that the often infallible Oracle of Burbank wasn't able to mystically forecast this past week's market movements with his usual accuracy? Like most intangible things, my reasons can't easily be quantified, but I think this best describes my situation for the week -

Monday, November 14, 2011

The Congressional Pass

Ever wonder how it is that many members of Congress leave their offices much richer than when they began their terms? Unlike the 99% of Americans who must abide by the rules of the game or be held accountable, Steve Kroft reports that members of Congress can legally trade stock (or other assets) based upon non-public information obtained on Capitol Hill.

We "average" Americans can be prosecuted for this type of criminal activity, but Congresspersons somehow get a pass on profiting from insider information.

Source: CBS News: 60 Minutes

We "average" Americans can be prosecuted for this type of criminal activity, but Congresspersons somehow get a pass on profiting from insider information.

Source: CBS News: 60 Minutes

Sunday, November 13, 2011

The Week Ahead

As last week's volatility showed, it takes a great degree of intestinal fortitude not to panic over short-term market movements. Any long investor who panicked at the beginning of the week and bailed, would have regretted it by the end of the week. Inversely, any who went short early in the week, would have also regretted it on Friday. Doing nothing turned out to be a good choice.

But, instead of writing a weekly wrap about the extreme volatility of last week, I thought I'd focus on the what I expect this week.

As anyone who follows the markets knows, they've been very reactionary lately, moving in extremes based only upon perceptions of economic uncertainties overseas reported by the news media, which has a way of perpetuating fear to serve their own agenda. However, like I said before, there's no way the Fed, the European Commission, the IMF, the bankers or the politicians in their pockets are going to allow economic failure anywhere for now. Failure is not an option.

And now that the fears surrounding the Grecian and Italian economies has been somewhat calmed, I don't see anything on the near-term horizon to hold back the markets this week. I'm still holding long, and expect this week to end on a largely positive note.

But, I say that with a small degree of uncertainty because the robber barons can easily manipulate the news reports if it serves their purpose. It goes without saying that if one looks for problems, they can always be found. And, as recent volatility in the markets has shown, the herd mentality is easily manipulated. Markets can turn on a dime.

So keeping that in mind, while I believe we will see gains for the week, one should always approach a running bull with a certain degree of caution. Not only does perceived fears often get us in trouble, but excessive greed has the tendency to do the same. Don't allow that greed to leave you in the hole.

Short Film 'The Black Hole' from PHOTOPLAY FILMS on Vimeo.

But, instead of writing a weekly wrap about the extreme volatility of last week, I thought I'd focus on the what I expect this week.

As anyone who follows the markets knows, they've been very reactionary lately, moving in extremes based only upon perceptions of economic uncertainties overseas reported by the news media, which has a way of perpetuating fear to serve their own agenda. However, like I said before, there's no way the Fed, the European Commission, the IMF, the bankers or the politicians in their pockets are going to allow economic failure anywhere for now. Failure is not an option.

And now that the fears surrounding the Grecian and Italian economies has been somewhat calmed, I don't see anything on the near-term horizon to hold back the markets this week. I'm still holding long, and expect this week to end on a largely positive note.

But, I say that with a small degree of uncertainty because the robber barons can easily manipulate the news reports if it serves their purpose. It goes without saying that if one looks for problems, they can always be found. And, as recent volatility in the markets has shown, the herd mentality is easily manipulated. Markets can turn on a dime.

So keeping that in mind, while I believe we will see gains for the week, one should always approach a running bull with a certain degree of caution. Not only does perceived fears often get us in trouble, but excessive greed has the tendency to do the same. Don't allow that greed to leave you in the hole.

Short Film 'The Black Hole' from PHOTOPLAY FILMS on Vimeo.

Tuesday, November 8, 2011

RIP Joe Frazier

Joe Frazier - the embodiment of determination. One of the greatest heavyweight champion boxers in the history of the sport, at a time when boxing was at it's zenith.

Sunday, November 6, 2011

Don't Let Your Fears Dictate Your Actions

In all of my years of being a successful individual investor, if there's one thing that I'm sure of, it's that there will always be someone trying to manipulate our fears in order to capitalize on our reactions. And conversely, there will always be someone trying to manipulate our emotions of greed.

As a matter of fact, it's capitalizing on those investors' reactions to perceived fears and greed that helps me successfully manage my own investments. It's been my experience that no matter what I say, show, or even prove to help them make better decisions, that most investors fail miserably at controlling their own emotions, and will almost always follow their herd instinct.

So, I usually bet against them. But, I'll continue to share my own personal views and opinions to help them beforehand because "that's the way I roll".

As such, heading into another uncertain week I think it's important that we try not to lose focus on the big picture, and not to sweat the small stuff that gets in our way. Short-term market movements are a competitive mind game designed to empty your pockets. Are you up to that challenge?

If not, don't allow your fears to dictate your actions. In periods of uncertainty, remaining patient and doing nothing is often your best choice. Before the week starts, burn away your Kookooee before it leads to poor choices and negatively impacts your finances.

The Burning of the Kookooee from Mark Archuleta on Vimeo.

As a matter of fact, it's capitalizing on those investors' reactions to perceived fears and greed that helps me successfully manage my own investments. It's been my experience that no matter what I say, show, or even prove to help them make better decisions, that most investors fail miserably at controlling their own emotions, and will almost always follow their herd instinct.

So, I usually bet against them. But, I'll continue to share my own personal views and opinions to help them beforehand because "that's the way I roll".

As such, heading into another uncertain week I think it's important that we try not to lose focus on the big picture, and not to sweat the small stuff that gets in our way. Short-term market movements are a competitive mind game designed to empty your pockets. Are you up to that challenge?

If not, don't allow your fears to dictate your actions. In periods of uncertainty, remaining patient and doing nothing is often your best choice. Before the week starts, burn away your Kookooee before it leads to poor choices and negatively impacts your finances.

The Burning of the Kookooee from Mark Archuleta on Vimeo.

Friday, November 4, 2011

Weekly Wrap

After another highly volatile week, all three major stock indices ended about 2% lower for the week. According to MarketWatch.com -

After experiencing one reported crisis after another on a daily basis for the past few months, it almost seems to me as if the financial media is the driving force behind this increased volatility, as opposed to anything measurable. It makes me wonder if they've discovered a direct relationship between worry, readership, and revenue, and are exploiting it?

I don't know. Am I way off-base in embracing this conspiratorial line of reasoning? You tell me.

U.S. stocks closed lower Friday, breaking a string of weekly gains as worries about Greece's future in the euro zone overrode mildly positive U.S. data.It's not surprising how high market volatility has been this past week, as economic uncertainty is so high as well. But, what has really changed, both economically and politically, this week as compared to the last six weeks? Nothing, except investors' perceptions of what's being reported.

After experiencing one reported crisis after another on a daily basis for the past few months, it almost seems to me as if the financial media is the driving force behind this increased volatility, as opposed to anything measurable. It makes me wonder if they've discovered a direct relationship between worry, readership, and revenue, and are exploiting it?

I don't know. Am I way off-base in embracing this conspiratorial line of reasoning? You tell me.

Wednesday, November 2, 2011

Bernanke "Does" Know Jack

With the economy mired in the worst downturn in decades, Fed Chairman Ben Bernanke has been taking heat from all sides. According to an MSNBC report of the Fed Chief's press conference after today's FOMC meeting -

But, what I'd really like to know is just what does the Fed Chief do to better prepare himself for the criticism that he knows he's going to receive every time his gives these press conferences? How does he maintain such a cool demeanor during tough questioning? What's his secret?

Fortunately, I think I may have answered my own questions. It just so happens that I've found video of him getting prepared last night, for today's FOMC presentation. Those investors who still think that Bernanke "doesn't know Jack" might want to reconsider their viewpoints.

Some of the criticism has come from the left, including the widening Occupy Wall Street protest movement, which faults the Fed for bailing out bankers who made the risky bets that led to the collapse. Those critics, Bernanke said, don’t fully understand the reasons for the Fed’s massive intervention following the financial meltdown.If you watch the accompanying video, you can see that Bernanke handles criticism very well. But, I've never really been interested in what Bernanke has to say concerning the Federal Reserve or his views on the economy. I have my own views, follow my own instincts, and make my own decisions.

But, what I'd really like to know is just what does the Fed Chief do to better prepare himself for the criticism that he knows he's going to receive every time his gives these press conferences? How does he maintain such a cool demeanor during tough questioning? What's his secret?

Fortunately, I think I may have answered my own questions. It just so happens that I've found video of him getting prepared last night, for today's FOMC presentation. Those investors who still think that Bernanke "doesn't know Jack" might want to reconsider their viewpoints.

Tuesday, November 1, 2011

How To Convince The Markets To Reverse Course

The markets decided to pull back the past two trading days, much to the considerable dismay of many short-term long traders. But, like I said before, the stock market is like a beautiful woman, fickle and harsh at times, but willing to give it up in a moment's notice.

I'd be willing to bet that if you only sweet talked the market, like you would a woman whom you've really missed, she might forgive you and come right back. But, the key to success depends on your ability to fully convince her to break through her resistance. Sometimes that can be a little tough.

However, I think these talented traders might have discovered the best method to sweet talk the market, convince her to let go of her short-term fears, and allow you to continue to go long on her.

I'd be willing to bet that if you only sweet talked the market, like you would a woman whom you've really missed, she might forgive you and come right back. But, the key to success depends on your ability to fully convince her to break through her resistance. Sometimes that can be a little tough.

However, I think these talented traders might have discovered the best method to sweet talk the market, convince her to let go of her short-term fears, and allow you to continue to go long on her.

Subscribe to:

Posts (Atom)