The stock markets reversed course to start the holiday-shortened week, with all three major market indices falling between 1-1.4 percent on light to moderate volume. The S&P 500 is back in the red for the year - and I think it might have been my fault.

What was I thinking? A kind word, a show of affection, and some positive encouragement usually can change the sentiment of even the most stubborn of women. But, I mistakenly forgot that the towards the end of the year, the stock market sometimes doesn't behave like a forgiving woman, but more like a selfish and possessed little girl.

And while kind words and encouragement work for young ladies too, sometimes they require a little tough love and firmness in order to get them motivated. So, a change of strategy is required. Let's see if this exorcises her demons and helps turn her funky attitude around for the rest of the week.

[You may have to turn up the volume to get the point across]

Wednesday, December 28, 2011

Sunday, December 25, 2011

Are You Ready For The Next Stage?

I'm expecting more gains this week, but whaddya say we give it a little help?

I pretty sure that I've said it before - the stock market is like a beautiful woman, fickle and unforgiving at times, but willing to give it up in a moment's notice. So, when things seem to be going downhill, show her some love and positive encouragement, and just watch her sentiment change for the better.

Let's get her ready for this week and close out 2011 on a positive note.

I pretty sure that I've said it before - the stock market is like a beautiful woman, fickle and unforgiving at times, but willing to give it up in a moment's notice. So, when things seem to be going downhill, show her some love and positive encouragement, and just watch her sentiment change for the better.

Let's get her ready for this week and close out 2011 on a positive note.

Wednesday, December 21, 2011

Have A Wonderful Holiday!

Two of the best gifts any investor could ask for this holiday season is having the ability to see through all of the daily bullshit, and having caring friends we can count on when times get tough. Wishing you all the very healthiest, wealthiest, and wonderful holiday season.

Monday, December 19, 2011

Should I Stay or Should I Go?

This fucking stock market. It's got investors coming and going. Nobody knows what the hell is going on. My intuition is usually pretty damn good, but recently, I have no idea what the hell is going on. Like I said before, the stock market is just like a woman. I guess that in this case, it's going to take some time for her to tell us exactly what's on her mind.

Thursday, December 15, 2011

Where's The Missing Money?

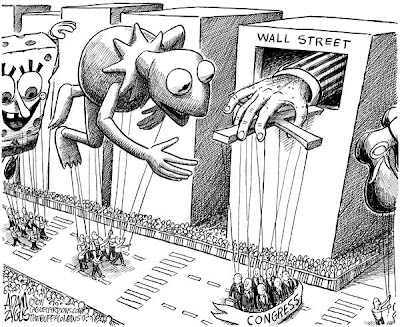

Almost everyone I know has that little voice in the back of their head telling them what to do when making important decisions that could affect others. The ethical ones usually have a voice telling them to think about others first, and to do the right thing. The unethical ones voices seem to tell them to think only of themselves, and to just "Do it!".

So, when I recently read about Jon Corzine, other Wall Street leaders, and their minions conveniently losing their memories or pleading ignorance during Congressional testimony, I wonder what their little voices tell them before they make their important decisions?

So, when I recently read about Jon Corzine, other Wall Street leaders, and their minions conveniently losing their memories or pleading ignorance during Congressional testimony, I wonder what their little voices tell them before they make their important decisions?

Tuesday, December 13, 2011

FOMC Statement

Looks like the markets weren't pleased with the Federal Open Market Committee (FOMC) Statement today. According to an excerpt from the committee statement -

Regardless, this isn't Kansas. I'm still holding long and not as fearful as most investors.

I'm expecting the stock market to turn around soon at this stage. I have a few select stocks on my radar screen that I didn't capitalize on during the previous downturn, and will take a position in one or more of them if their prices continue to drop further.

Information received since the Federal Open Market Committee met in November suggests that the economy has been expanding moderately, notwithstanding some apparent slowing in global growth. While indicators point to some improvement in overall labor market conditions, the unemployment rate remains elevated. Household spending has continued to advance, but business fixed investment appears to be increasing less rapidly and the housing sector remains depressed. Inflation has moderated since earlier in the year, and longer-term inflation expectations have remained stable.But, the by the looks of how the markets reacted today, investors aren't believing whatever the Fed has to say, or perhaps they thought this is what the FOMC actually meant to say -

Regardless, this isn't Kansas. I'm still holding long and not as fearful as most investors.

I'm expecting the stock market to turn around soon at this stage. I have a few select stocks on my radar screen that I didn't capitalize on during the previous downturn, and will take a position in one or more of them if their prices continue to drop further.

Friday, December 9, 2011

60 Minutes: Prosecuting Wall Street

Nothing anyone says about the 2007-2008 financial crisis outrages me anymore. I've already been convinced years ago that we Americans don't live in a Republic or a Democracy, but instead are ruled through Corporatocracy. Simply put, the criminals run the show, and will continue to do so until the whole system eventually comes crashing down because of their actions.

But, for those who think otherwise and still have faith in the system, I thought I'd post these two ironically-sponsored 60 Minutes videos entitled, "Prosecuting Wall Street", that support my views.

But, for those who think otherwise and still have faith in the system, I thought I'd post these two ironically-sponsored 60 Minutes videos entitled, "Prosecuting Wall Street", that support my views.

Friday, December 2, 2011

Thursday, December 1, 2011

Bill Moyers Is Back

Bill calls it plutocracy, I call it corporatocracy. As you may have already heard, Bill Moyers is coming back in January with a new series on the public television station nearest you. Welcome back Bill!

Bill Moyers Essay: Plutocracy and Democracy Don't Mix from BillMoyers.com on Vimeo.

Bill Moyers Essay: Plutocracy and Democracy Don't Mix from BillMoyers.com on Vimeo.

Wednesday, November 30, 2011

Thinking Outside The Box

It's a tough economy out there and many people are desperate for any kind of work. Desperate times call for desperate measures when the bill collector comes a calling. Getting ahead requires thinking outside of the box. But, don't just take my word for it.

Cassies - "The Pitch" from Cartilage Inc. on Vimeo.

Cassies - "The Pitch" from Cartilage Inc. on Vimeo.

Tuesday, November 29, 2011

Quants: The Alchemists of Wall Street

The credit crisis has shown how the global financial system has become increasingly dependent on mathematical models trying to quantify human (economic) behavior. What are the risks of treating the economy and its markets as a complex machine? Will we be able to keep control of this model- based financial system, or have we created a monster?

Source: VPRO Backlight

Source: VPRO Backlight

Thursday, November 24, 2011

Happy Thanksgiving!

Well, as the markets have show these past two weeks, investors' economic fears (perhaps justifiably) have gotten the best of them. I'm not sure where we're headed in the near future, but if the markets keep heading south, I'm looking to capitalize on the opportunities being presented. In my opinion, things aren't as bleak as is being reported or being perceived by investors.

In this corrupt corporatocracy we live in, there are many things I could find fault with, but at least for today, I'm thankful for the non-financial things in my life, especially my good health. I hope you feel the same way and I wish you a very Happy Thanksgiving!

Image Source: Adam Zyglis: The Buffalo News

In this corrupt corporatocracy we live in, there are many things I could find fault with, but at least for today, I'm thankful for the non-financial things in my life, especially my good health. I hope you feel the same way and I wish you a very Happy Thanksgiving!

Image Source: Adam Zyglis: The Buffalo News

Sunday, November 20, 2011

Weekly Wrap

It was a rough week for me this previous week. The three major market indexes ended the week with a 3-4% loss. Not only was I wrong about where the stock market would end for the week, but the flu hit me like a ton of bricks on Thursday. My body felt like it was pummeled with a 2x4. I'm just finally getting halfway back to normal today.

So, how was it that the often infallible Oracle of Burbank wasn't able to mystically forecast this past week's market movements with his usual accuracy? Like most intangible things, my reasons can't easily be quantified, but I think this best describes my situation for the week -

So, how was it that the often infallible Oracle of Burbank wasn't able to mystically forecast this past week's market movements with his usual accuracy? Like most intangible things, my reasons can't easily be quantified, but I think this best describes my situation for the week -

Monday, November 14, 2011

The Congressional Pass

Ever wonder how it is that many members of Congress leave their offices much richer than when they began their terms? Unlike the 99% of Americans who must abide by the rules of the game or be held accountable, Steve Kroft reports that members of Congress can legally trade stock (or other assets) based upon non-public information obtained on Capitol Hill.

We "average" Americans can be prosecuted for this type of criminal activity, but Congresspersons somehow get a pass on profiting from insider information.

Source: CBS News: 60 Minutes

We "average" Americans can be prosecuted for this type of criminal activity, but Congresspersons somehow get a pass on profiting from insider information.

Source: CBS News: 60 Minutes

Sunday, November 13, 2011

The Week Ahead

As last week's volatility showed, it takes a great degree of intestinal fortitude not to panic over short-term market movements. Any long investor who panicked at the beginning of the week and bailed, would have regretted it by the end of the week. Inversely, any who went short early in the week, would have also regretted it on Friday. Doing nothing turned out to be a good choice.

But, instead of writing a weekly wrap about the extreme volatility of last week, I thought I'd focus on the what I expect this week.

As anyone who follows the markets knows, they've been very reactionary lately, moving in extremes based only upon perceptions of economic uncertainties overseas reported by the news media, which has a way of perpetuating fear to serve their own agenda. However, like I said before, there's no way the Fed, the European Commission, the IMF, the bankers or the politicians in their pockets are going to allow economic failure anywhere for now. Failure is not an option.

And now that the fears surrounding the Grecian and Italian economies has been somewhat calmed, I don't see anything on the near-term horizon to hold back the markets this week. I'm still holding long, and expect this week to end on a largely positive note.

But, I say that with a small degree of uncertainty because the robber barons can easily manipulate the news reports if it serves their purpose. It goes without saying that if one looks for problems, they can always be found. And, as recent volatility in the markets has shown, the herd mentality is easily manipulated. Markets can turn on a dime.

So keeping that in mind, while I believe we will see gains for the week, one should always approach a running bull with a certain degree of caution. Not only does perceived fears often get us in trouble, but excessive greed has the tendency to do the same. Don't allow that greed to leave you in the hole.

Short Film 'The Black Hole' from PHOTOPLAY FILMS on Vimeo.

But, instead of writing a weekly wrap about the extreme volatility of last week, I thought I'd focus on the what I expect this week.

As anyone who follows the markets knows, they've been very reactionary lately, moving in extremes based only upon perceptions of economic uncertainties overseas reported by the news media, which has a way of perpetuating fear to serve their own agenda. However, like I said before, there's no way the Fed, the European Commission, the IMF, the bankers or the politicians in their pockets are going to allow economic failure anywhere for now. Failure is not an option.

And now that the fears surrounding the Grecian and Italian economies has been somewhat calmed, I don't see anything on the near-term horizon to hold back the markets this week. I'm still holding long, and expect this week to end on a largely positive note.

But, I say that with a small degree of uncertainty because the robber barons can easily manipulate the news reports if it serves their purpose. It goes without saying that if one looks for problems, they can always be found. And, as recent volatility in the markets has shown, the herd mentality is easily manipulated. Markets can turn on a dime.

So keeping that in mind, while I believe we will see gains for the week, one should always approach a running bull with a certain degree of caution. Not only does perceived fears often get us in trouble, but excessive greed has the tendency to do the same. Don't allow that greed to leave you in the hole.

Short Film 'The Black Hole' from PHOTOPLAY FILMS on Vimeo.

Tuesday, November 8, 2011

RIP Joe Frazier

Joe Frazier - the embodiment of determination. One of the greatest heavyweight champion boxers in the history of the sport, at a time when boxing was at it's zenith.

Sunday, November 6, 2011

Don't Let Your Fears Dictate Your Actions

In all of my years of being a successful individual investor, if there's one thing that I'm sure of, it's that there will always be someone trying to manipulate our fears in order to capitalize on our reactions. And conversely, there will always be someone trying to manipulate our emotions of greed.

As a matter of fact, it's capitalizing on those investors' reactions to perceived fears and greed that helps me successfully manage my own investments. It's been my experience that no matter what I say, show, or even prove to help them make better decisions, that most investors fail miserably at controlling their own emotions, and will almost always follow their herd instinct.

So, I usually bet against them. But, I'll continue to share my own personal views and opinions to help them beforehand because "that's the way I roll".

As such, heading into another uncertain week I think it's important that we try not to lose focus on the big picture, and not to sweat the small stuff that gets in our way. Short-term market movements are a competitive mind game designed to empty your pockets. Are you up to that challenge?

If not, don't allow your fears to dictate your actions. In periods of uncertainty, remaining patient and doing nothing is often your best choice. Before the week starts, burn away your Kookooee before it leads to poor choices and negatively impacts your finances.

The Burning of the Kookooee from Mark Archuleta on Vimeo.

As a matter of fact, it's capitalizing on those investors' reactions to perceived fears and greed that helps me successfully manage my own investments. It's been my experience that no matter what I say, show, or even prove to help them make better decisions, that most investors fail miserably at controlling their own emotions, and will almost always follow their herd instinct.

So, I usually bet against them. But, I'll continue to share my own personal views and opinions to help them beforehand because "that's the way I roll".

As such, heading into another uncertain week I think it's important that we try not to lose focus on the big picture, and not to sweat the small stuff that gets in our way. Short-term market movements are a competitive mind game designed to empty your pockets. Are you up to that challenge?

If not, don't allow your fears to dictate your actions. In periods of uncertainty, remaining patient and doing nothing is often your best choice. Before the week starts, burn away your Kookooee before it leads to poor choices and negatively impacts your finances.

The Burning of the Kookooee from Mark Archuleta on Vimeo.

Friday, November 4, 2011

Weekly Wrap

After another highly volatile week, all three major stock indices ended about 2% lower for the week. According to MarketWatch.com -

After experiencing one reported crisis after another on a daily basis for the past few months, it almost seems to me as if the financial media is the driving force behind this increased volatility, as opposed to anything measurable. It makes me wonder if they've discovered a direct relationship between worry, readership, and revenue, and are exploiting it?

I don't know. Am I way off-base in embracing this conspiratorial line of reasoning? You tell me.

U.S. stocks closed lower Friday, breaking a string of weekly gains as worries about Greece's future in the euro zone overrode mildly positive U.S. data.It's not surprising how high market volatility has been this past week, as economic uncertainty is so high as well. But, what has really changed, both economically and politically, this week as compared to the last six weeks? Nothing, except investors' perceptions of what's being reported.

After experiencing one reported crisis after another on a daily basis for the past few months, it almost seems to me as if the financial media is the driving force behind this increased volatility, as opposed to anything measurable. It makes me wonder if they've discovered a direct relationship between worry, readership, and revenue, and are exploiting it?

I don't know. Am I way off-base in embracing this conspiratorial line of reasoning? You tell me.

Wednesday, November 2, 2011

Bernanke "Does" Know Jack

With the economy mired in the worst downturn in decades, Fed Chairman Ben Bernanke has been taking heat from all sides. According to an MSNBC report of the Fed Chief's press conference after today's FOMC meeting -

But, what I'd really like to know is just what does the Fed Chief do to better prepare himself for the criticism that he knows he's going to receive every time his gives these press conferences? How does he maintain such a cool demeanor during tough questioning? What's his secret?

Fortunately, I think I may have answered my own questions. It just so happens that I've found video of him getting prepared last night, for today's FOMC presentation. Those investors who still think that Bernanke "doesn't know Jack" might want to reconsider their viewpoints.

Some of the criticism has come from the left, including the widening Occupy Wall Street protest movement, which faults the Fed for bailing out bankers who made the risky bets that led to the collapse. Those critics, Bernanke said, don’t fully understand the reasons for the Fed’s massive intervention following the financial meltdown.If you watch the accompanying video, you can see that Bernanke handles criticism very well. But, I've never really been interested in what Bernanke has to say concerning the Federal Reserve or his views on the economy. I have my own views, follow my own instincts, and make my own decisions.

But, what I'd really like to know is just what does the Fed Chief do to better prepare himself for the criticism that he knows he's going to receive every time his gives these press conferences? How does he maintain such a cool demeanor during tough questioning? What's his secret?

Fortunately, I think I may have answered my own questions. It just so happens that I've found video of him getting prepared last night, for today's FOMC presentation. Those investors who still think that Bernanke "doesn't know Jack" might want to reconsider their viewpoints.

Tuesday, November 1, 2011

How To Convince The Markets To Reverse Course

The markets decided to pull back the past two trading days, much to the considerable dismay of many short-term long traders. But, like I said before, the stock market is like a beautiful woman, fickle and harsh at times, but willing to give it up in a moment's notice.

I'd be willing to bet that if you only sweet talked the market, like you would a woman whom you've really missed, she might forgive you and come right back. But, the key to success depends on your ability to fully convince her to break through her resistance. Sometimes that can be a little tough.

However, I think these talented traders might have discovered the best method to sweet talk the market, convince her to let go of her short-term fears, and allow you to continue to go long on her.

I'd be willing to bet that if you only sweet talked the market, like you would a woman whom you've really missed, she might forgive you and come right back. But, the key to success depends on your ability to fully convince her to break through her resistance. Sometimes that can be a little tough.

However, I think these talented traders might have discovered the best method to sweet talk the market, convince her to let go of her short-term fears, and allow you to continue to go long on her.

Sunday, October 30, 2011

Be "One" With The Markets

I've always been asked how is that I can see things others cannot see, or refuse to see? How is it that I know what's going to happen, just before it happens? I use what I call "market meditation".

When it comes to investing, I'm a fundamentalist. It's hard to argue with the math.

But, years of experience have also taught me to think for myself, trust my instinct and intuition, and to have faith in my own abilities. People move the markets, and I have this keen ability to understand people's fears and motivations, and to correctly gauge how they will react based on their beliefs and perceptions. As such, this ability allows me to "be one with the markets".

But, people always want concrete answers for things that can't easily be explained.

Unfortunately, the only way I know how to explain my continual success is that - when you cease to strive to understand irrational markets, then you will know - without understanding.

When it comes to investing, I'm a fundamentalist. It's hard to argue with the math.

But, years of experience have also taught me to think for myself, trust my instinct and intuition, and to have faith in my own abilities. People move the markets, and I have this keen ability to understand people's fears and motivations, and to correctly gauge how they will react based on their beliefs and perceptions. As such, this ability allows me to "be one with the markets".

But, people always want concrete answers for things that can't easily be explained.

Unfortunately, the only way I know how to explain my continual success is that - when you cease to strive to understand irrational markets, then you will know - without understanding.

Friday, October 28, 2011

Are You Being Played Again?

I've been reading more and more manipulative reports lately in the financial media, attempting to shift blame for this economic crisis onto the gullible rubes who bought homes at, or near, the peak of the housing bubble. It seems as though the people in these reports are saying "you bought the bag of goods we were selling, so it's your current debt, your unemployment, and your inability to qualify for even more debt that's perpetuating the problem."

That's right, it's not the people who encouraged you to apply for a mortgage they knew you couldn't possibly afford, told you that a $100,000.00 home was really worth $500,000.00 and appraised it as such, loaned you 100% (or more) of the home price knowing that taxpayers would be stuck paying the bill if you defaulted, and then packaged these fraudulent loans and sold them to gullible investors as "safe" investments.

It's YOUR FAULT for not seeing through their criminal enterprise.

Be a critical reader folks and you'll see that what I'm saying is correct. Underwater homeowners are being blamed more and more for current economic conditions. Unbelievably, the perpetrators of this historic financial crisis are now blaming your debt for their crimes. It's almost as though the victims of these crimes are now being considered the perpetrators.

Do I really need to say that it's not your fault? For goodness sake, don't be played AGAIN!

The REAL perpetrators want you to forget that the actual cause of our economic crisis stems from fraudulent financial derivatives created by Wall Street, corrupt politicians, crooked mortgage lenders, and an unethical real estate industry, all of whom exploited your foolish gullibility.. and freely continue to do so to this day.

So, I'm posting this seminal investigation of the real causes behind this economic crisis, conducted by the unerringly ethical investigative reporters at PBS FRONTLINE.

This way you can decide for yourself if our current economic problems are truly your fault.

Source: PBS Frontline, The Warning.

That's right, it's not the people who encouraged you to apply for a mortgage they knew you couldn't possibly afford, told you that a $100,000.00 home was really worth $500,000.00 and appraised it as such, loaned you 100% (or more) of the home price knowing that taxpayers would be stuck paying the bill if you defaulted, and then packaged these fraudulent loans and sold them to gullible investors as "safe" investments.

It's YOUR FAULT for not seeing through their criminal enterprise.

Be a critical reader folks and you'll see that what I'm saying is correct. Underwater homeowners are being blamed more and more for current economic conditions. Unbelievably, the perpetrators of this historic financial crisis are now blaming your debt for their crimes. It's almost as though the victims of these crimes are now being considered the perpetrators.

Do I really need to say that it's not your fault? For goodness sake, don't be played AGAIN!

The REAL perpetrators want you to forget that the actual cause of our economic crisis stems from fraudulent financial derivatives created by Wall Street, corrupt politicians, crooked mortgage lenders, and an unethical real estate industry, all of whom exploited your foolish gullibility.. and freely continue to do so to this day.

So, I'm posting this seminal investigation of the real causes behind this economic crisis, conducted by the unerringly ethical investigative reporters at PBS FRONTLINE.

This way you can decide for yourself if our current economic problems are truly your fault.

Source: PBS Frontline, The Warning.

Wednesday, October 26, 2011

The Instability of Inequality

Do you ever get that feeling that you know something is fundamentally wrong but you just can't fully put your finger on it, or express exactly what's bothering you? That's often my case.

So, when I read Nouriel Roubini's commentary, The Instability of Inequality, on Project Syndicate, I realized that what he says almost expresses how I feel about our economic turmoil and the Occupy Wall Street movement. As excerpted from this article, Roubini says -

But, as often happens, ivory tower solutions are often based upon altruistic ideals. We tend to think that people who are elected, appointed, or otherwise paid to address these situations will always act on behalf of Americans as a whole, instead of acting upon their own personal agendas.

To me, that's the crux of the problem. America was already operating on a great economic model that was created from the ashes of The Great Depression. We didn't need to create a new model to replace it, what we needed was enforcement of our old model. All economic models will fail if the rules of those models aren't enforced.

And there's the rub. How do you create a functioning economic model when the people running the show don't want it? The people in charge of enforcing our previously functioning economic model weren't altruistic. They pursued their own individual agendas instead of watching out for our country collectively, and allowed that model to become "legally" corrupted in order to serve their own needs.

And, what's sad to me is that I don't believe that there are enough altruistic people left to change the status quo. I think many Americans have already lost faith in our leaders to do what's best for the country, regardless of their political affiliations. Personally, I don't see things changing anytime soon.

I mean, even the man who was elected on the basis of hope and change seems to be pursuing his own individual agenda. But, don't take my word for it, see for yourself -

So, when I read Nouriel Roubini's commentary, The Instability of Inequality, on Project Syndicate, I realized that what he says almost expresses how I feel about our economic turmoil and the Occupy Wall Street movement. As excerpted from this article, Roubini says -

Even before the Great Depression, Europe’s enlightened “bourgeois” classes recognized that, to avoid revolution, workers’ rights needed to be protected, wage and labor conditions improved, and a welfare state created to redistribute wealth and finance public goods – education, health care, and a social safety net. The push towards a modern welfare state accelerated after the Great Depression, when the state took on the responsibility for macroeconomic stabilization – a role that required the maintenance of a large middle class by widening the provision of public goods through progressive taxation of incomes and wealth and fostering economic opportunity for all.When you read the full article, you'll see that Roubini is a very intelligent economist whose insights cut right to the point. He's pointed out the specific problems, and I'm sure he's also prepared an economic model designed to address those problems (for a fee of course).

But, as often happens, ivory tower solutions are often based upon altruistic ideals. We tend to think that people who are elected, appointed, or otherwise paid to address these situations will always act on behalf of Americans as a whole, instead of acting upon their own personal agendas.

To me, that's the crux of the problem. America was already operating on a great economic model that was created from the ashes of The Great Depression. We didn't need to create a new model to replace it, what we needed was enforcement of our old model. All economic models will fail if the rules of those models aren't enforced.

And there's the rub. How do you create a functioning economic model when the people running the show don't want it? The people in charge of enforcing our previously functioning economic model weren't altruistic. They pursued their own individual agendas instead of watching out for our country collectively, and allowed that model to become "legally" corrupted in order to serve their own needs.

And, what's sad to me is that I don't believe that there are enough altruistic people left to change the status quo. I think many Americans have already lost faith in our leaders to do what's best for the country, regardless of their political affiliations. Personally, I don't see things changing anytime soon.

I mean, even the man who was elected on the basis of hope and change seems to be pursuing his own individual agenda. But, don't take my word for it, see for yourself -

Tuesday, October 25, 2011

Happy Halloween Traders

It's easy to get squashed when people are running scared. Always expect the unexpected and you'll never be disappointed when short-term market movements don't go your way.

Thursday, October 20, 2011

"Mini-Madoff" Guilty Of $400 Million Ponzi Scheme

Wolfman Jack doppelgänger Nicholas Cosmo, 40, owner of Agape World Inc and Agape Merchant Advance, was sentenced to 25 years in prison earlier this month after admitting to stealing more than $195 million from thousands of investors in the course of a five-year, $400-million Ponzi scheme.

I'm mentioning this one specific Ponzi scheme because unlike many of Madoff's victims, who were well-off socialites, charities or corporations, Cosmo and Agape preyed on working-class families, U.S. service-persons and others who wound up losing all or part of their life savings. I can identify with this group of citizens and sympathize with the hardships that they'll now have to endure.

I'm also mentioning it because this is not the first time Cosmo has perpetrated such a crime, and served prison time for it. Personally, I think Cosmo should have gotten a life sentence since he's already proven his propensity for recidivism. I don't think the man is capable of remorse and could care less about the victims of his crimes.

But, his lawyers have argued differently and say he's sorry for what he's done. As a matter of fact, I've been given this alleged audio tape of Cosmo and his cohorts discussing their crimes while on the run from the law, and hiding out on a ranch in the southwest. What do you think?

I'm mentioning this one specific Ponzi scheme because unlike many of Madoff's victims, who were well-off socialites, charities or corporations, Cosmo and Agape preyed on working-class families, U.S. service-persons and others who wound up losing all or part of their life savings. I can identify with this group of citizens and sympathize with the hardships that they'll now have to endure.

I'm also mentioning it because this is not the first time Cosmo has perpetrated such a crime, and served prison time for it. Personally, I think Cosmo should have gotten a life sentence since he's already proven his propensity for recidivism. I don't think the man is capable of remorse and could care less about the victims of his crimes.

But, his lawyers have argued differently and say he's sorry for what he's done. As a matter of fact, I've been given this alleged audio tape of Cosmo and his cohorts discussing their crimes while on the run from the law, and hiding out on a ranch in the southwest. What do you think?

Sunday, October 16, 2011

Occupy Phoenix

An offshoot of the Occupy Wall Street movement that began last month in New York City, more than a thousand people packed Cesar Chavez Plaza in downtown Phoenix on Saturday to protest what many view as a government operating in cahoots with the major corporations.

Image source: Mike Harris, KPHO.com/CBS 5 News

The reason I'm mentioning it is because the "Occupy" protesters are often labeled in general as being hippies, wackos, lazy bums, disgruntled homeless, or as some other derogatory term, perhaps used in order to reduce their credibility.

But, if you look closer at the Occupy Phoenix protesters, there seems to be many who look just like you and me, the typical average American, and don't fit into those derogatory categories often used to characterized the Occupy Wall Street protesters. The two ladies pictured above look more than capable enough to me to be able to express just what it is that bothers them, and bothers me too.

Now, I do have to agree with "Occupy" detractors that this movement doesn't really have any defined leadership, clear-cut solutions, or a plan in place designed to fix things. I think that it's more of an expression of dissatisfaction and disillusionment than anything else. I'm also of the opinion that the system is too corrupt to change, and that changing it by civil protest is likely impossible.

However, anyone who's experienced the civil unrest of the 1960s and 1970s can tell you that these types of protests have a way of gaining momentum, and shouldn't be dismissed lightly by those running the show. People don't tolerate injustices for very long - one thing could lead to another.

Image source: Mike Harris, KPHO.com/CBS 5 News

The reason I'm mentioning it is because the "Occupy" protesters are often labeled in general as being hippies, wackos, lazy bums, disgruntled homeless, or as some other derogatory term, perhaps used in order to reduce their credibility.

But, if you look closer at the Occupy Phoenix protesters, there seems to be many who look just like you and me, the typical average American, and don't fit into those derogatory categories often used to characterized the Occupy Wall Street protesters. The two ladies pictured above look more than capable enough to me to be able to express just what it is that bothers them, and bothers me too.

Now, I do have to agree with "Occupy" detractors that this movement doesn't really have any defined leadership, clear-cut solutions, or a plan in place designed to fix things. I think that it's more of an expression of dissatisfaction and disillusionment than anything else. I'm also of the opinion that the system is too corrupt to change, and that changing it by civil protest is likely impossible.

However, anyone who's experienced the civil unrest of the 1960s and 1970s can tell you that these types of protests have a way of gaining momentum, and shouldn't be dismissed lightly by those running the show. People don't tolerate injustices for very long - one thing could lead to another.

Friday, October 14, 2011

Weekly Wrap

What happened in only two weeks to make market sentiment reverse course so sharply? Absolutely nothing but financial media manipulation and the market "experts" calling it wrong again.

The markets didn't plunge, recessionary fears calmed, and economic data came in better than expected. The past two weeks saw the Dow and Nasdaq climb back into positive territory for the year, up 6.6% and 10.2% respectively, and the S&P 500 rise 7.2% in the same time period.

My stock pick position in KND is back in the black after being initially "Ganned", and if anyone would have entered a position in DEG when I mentioned it, it would have been good for a ten-point gain.

So, it looks like my forecast was right on the mark, so far. But, like I said, the market is like a fickle woman, and can turn on a dime if she doesn't like what she hears. All in all, it was a pretty good two weeks. If breaking through resistance means anything, then next week should likely follow suit.

But don't just take my word for it, see what these technical analysts reported on Friday.

The markets didn't plunge, recessionary fears calmed, and economic data came in better than expected. The past two weeks saw the Dow and Nasdaq climb back into positive territory for the year, up 6.6% and 10.2% respectively, and the S&P 500 rise 7.2% in the same time period.

My stock pick position in KND is back in the black after being initially "Ganned", and if anyone would have entered a position in DEG when I mentioned it, it would have been good for a ten-point gain.

So, it looks like my forecast was right on the mark, so far. But, like I said, the market is like a fickle woman, and can turn on a dime if she doesn't like what she hears. All in all, it was a pretty good two weeks. If breaking through resistance means anything, then next week should likely follow suit.

But don't just take my word for it, see what these technical analysts reported on Friday.

Tuesday, October 11, 2011

Occupy Wall Street Recruitment Video

This Occupy Wall Street movement that's been in the news lately is really gaining momentum, and has now extended itself to other major cities throughout America, even out in California.

Personally, I'm not sure what to make of these protests. Although I can sympathize with their cause, I'm not so sure that they have a good enough plan in place to achieve their vague objectives. It seems to me to be more of a "bitch session" than a radical movement for changing a corrupt system.

But, I guess it doesn't matter what I think anyway, because more and more people are joining the movement daily. I'm sure that a lot of Americans are angry and fed up with white-collar crime and corruption affecting our economy, but I've also been wondering how Occupy Wall Street has been getting such vast numbers of people to join their protests.

That is, until I received this recruitment video in an email today.

Personally, I'm not sure what to make of these protests. Although I can sympathize with their cause, I'm not so sure that they have a good enough plan in place to achieve their vague objectives. It seems to me to be more of a "bitch session" than a radical movement for changing a corrupt system.

But, I guess it doesn't matter what I think anyway, because more and more people are joining the movement daily. I'm sure that a lot of Americans are angry and fed up with white-collar crime and corruption affecting our economy, but I've also been wondering how Occupy Wall Street has been getting such vast numbers of people to join their protests.

That is, until I received this recruitment video in an email today.

Monday, October 10, 2011

Do You Control Your Own Destiny?

Learn the core secrets about the road to successful investing.

THE ROAD TO SUCCESS from Dimitri Ellerington on Vimeo.

THE ROAD TO SUCCESS from Dimitri Ellerington on Vimeo.

Monday, October 3, 2011

A Contrarian Stock Market Viewpoint

If you're cynical enough to believe that most people will do whatever is in their own best interests, and often at the expense of others, then you'll come to understand that almost everything happens for a reason instead of by chance.

Take the past week's stock market action for example. The two main emotions that usually dictate investors' behaviors are greed and fear, and the short-term price of stocks is usually directly proportional to how investors react to these two emotions.

Right now, investors are freaking out and selling their investments out of fear. Either fear of economic collapse, fear of going broke, or just plain fear of the unknown. However, the bright side of this market bailout is that the panic has brought back one of my favorite dance crazes from the 1970s.

All kidding aside though, a good contrarian investor realizes that there's usually an ulterior motive behind all of this fear, and it likely has something to do with the evil forces of excessive greed - Wall Street, and their corporate and political cronies. They're deviously skilled at generating profits by manipulating the perception of fear, uncertainty, and creating market volatility.

As such, I see this pullback as cause for inversely celebrating good times. Instead of running with the herd and fleeing the markets like everyone else, I'm going to continue to do what the criminals are doing and use my cash position to invest in select stocks, ETFs, or funds while they're on sale.

Take the past week's stock market action for example. The two main emotions that usually dictate investors' behaviors are greed and fear, and the short-term price of stocks is usually directly proportional to how investors react to these two emotions.

Right now, investors are freaking out and selling their investments out of fear. Either fear of economic collapse, fear of going broke, or just plain fear of the unknown. However, the bright side of this market bailout is that the panic has brought back one of my favorite dance crazes from the 1970s.

All kidding aside though, a good contrarian investor realizes that there's usually an ulterior motive behind all of this fear, and it likely has something to do with the evil forces of excessive greed - Wall Street, and their corporate and political cronies. They're deviously skilled at generating profits by manipulating the perception of fear, uncertainty, and creating market volatility.

As such, I see this pullback as cause for inversely celebrating good times. Instead of running with the herd and fleeing the markets like everyone else, I'm going to continue to do what the criminals are doing and use my cash position to invest in select stocks, ETFs, or funds while they're on sale.

Friday, September 30, 2011

ECRI Predicts New Recession

Weakness in leading economic indicators has become so pervasive that Economic Cycle Research Institute co-founder Lakshman Achuthan now predicts a new recession is unavoidable and states - "You haven't seen anything yet. It's going to get a lot worse."

However, I'm not jumping on the "new recession" bandwagon just yet, and believe the Fed will do anything to prevent another recession. But, there is the good possibility that Achuthan is correct when he says "we ain't seen nothing yet", and we just may see stock prices drop even further.

Personally, I believe the stock market is a like a beautiful woman, fickle and unforgiving at times, but willing to give it up in a moment's notice. So, I see this recent pullback in the markets, based on those recession fears, as an opportunity to "get some" select stocks cheaply while I can.

However, I'm not jumping on the "new recession" bandwagon just yet, and believe the Fed will do anything to prevent another recession. But, there is the good possibility that Achuthan is correct when he says "we ain't seen nothing yet", and we just may see stock prices drop even further.

Personally, I believe the stock market is a like a beautiful woman, fickle and unforgiving at times, but willing to give it up in a moment's notice. So, I see this recent pullback in the markets, based on those recession fears, as an opportunity to "get some" select stocks cheaply while I can.

Wednesday, September 28, 2011

Are You Smarter Than The Market?

I keep the main bulk of savings appropriately allocated according to my tolerance for risk and my age, and invest it in low-cost index funds offered by The Vanguard Group. But, I keep a small portion of my portfolio invested in cash, and use it to speculate in the markets. Over the past ten years or so, I've been very successful, and have significantly outperformed the bulk portion of my portfolio.

However, if you're an individual investor who doesn't want to spend a significant amount of your time and energy trying to "manage" your investments, here's some good investing advice from Jack Bogle, The Vanguard Group founder and the creator of low-cost "passive" index fund investing.

However, if you're an individual investor who doesn't want to spend a significant amount of your time and energy trying to "manage" your investments, here's some good investing advice from Jack Bogle, The Vanguard Group founder and the creator of low-cost "passive" index fund investing.

Wednesday, September 21, 2011

A Message From Wall Street

After being reported today just how extensive the corruption is at the SEC, Wall Street decided to release this message to Government regulators and the gullible American investor.

Tuesday, September 6, 2011

A Message To The POTUS

Economic growth is faltering. Now is not the time to take a wait-and-see approach. You're going to have to pull your team together and take some much needed action to pull us out of this mess.

Don't wanna wait 'til tomorrow. Why put it off another day?

One by one, little problems, build up and stand in our way

One step ahead, one step behind it. Now you gotta run to get even

Make future plans I'll dream about yesterday, hey!

Come on turn, turn this thing around

(Right now) Hey! It's your tomorrow

(Right now) Come on, it's everything

(Right now) Catch your magic moment

Do it right here and now. It means everything

Miss a beat, you lose a rhythm, an nothin' falls into place

Only missed by a fraction, slipped a little off your pace

The more things you get, the more you want. Just trade in one for another

Workin' so hard to make it easy. Whoa, got to turn. Come on, turn this thing around

(Right now) Hey, it's your tomorrow

(Right now) Come on, it's everything

(Right now) Catch that magic moment

Do it right here and now, it means everything

Said a lie to me, right now. What are ya waitin' for? Right now!

(Right now) Hey! It's your tomorrow

(Right now) Come on, it's everything

(Right now) Catch that magic moment

And do it right, right now (Right now)

Oh, right now.

It's what's happening, right here and now

Right now, it's right now!

Tell me, what are ya waitin' for?

Don't wanna wait 'til tomorrow. Why put it off another day?

One by one, little problems, build up and stand in our way

One step ahead, one step behind it. Now you gotta run to get even

Make future plans I'll dream about yesterday, hey!

Come on turn, turn this thing around

(Right now) Hey! It's your tomorrow

(Right now) Come on, it's everything

(Right now) Catch your magic moment

Do it right here and now. It means everything

Miss a beat, you lose a rhythm, an nothin' falls into place

Only missed by a fraction, slipped a little off your pace

The more things you get, the more you want. Just trade in one for another

Workin' so hard to make it easy. Whoa, got to turn. Come on, turn this thing around

(Right now) Hey, it's your tomorrow

(Right now) Come on, it's everything

(Right now) Catch that magic moment

Do it right here and now, it means everything

Said a lie to me, right now. What are ya waitin' for? Right now!

(Right now) Hey! It's your tomorrow

(Right now) Come on, it's everything

(Right now) Catch that magic moment

And do it right, right now (Right now)

Oh, right now.

It's what's happening, right here and now

Right now, it's right now!

Tell me, what are ya waitin' for?

Saturday, September 3, 2011

Fiscal Versus Monetary Policy

Some investors talk of abolishing The Fed or having it come directly under Government control. But do we really want both monetary policy and fiscal policy to be controlled by corrupt politicians doing the bidding of their corporate owners? Would that really be of any benefit to our struggling economy?

Fiscal and Monetary Policy from Marketplace on Vimeo.

Fiscal and Monetary Policy from Marketplace on Vimeo.

Friday, September 2, 2011

Keeping Things In Perspective

Trust is important for an investor. As long as you can keep things in perspective.

TRUST from Rex Martin on Vimeo.

TRUST from Rex Martin on Vimeo.

Subscribe to:

Posts (Atom)